With almost ~$50 trillion in global assets, pension funds have a significant impact on the environment through their investment decisions and shareholder actions.

At Ethos we decided to use our platform to analyze the environmental impact of three of the largest pension funds in the United States. We looked at publicly available long equity and fixed income holdings of California Public Employees’ Retirement System (CalPERS), New York State Common Retirement Fund and the Teacher Retirement System of Texas (TRS) pension fund.

We mapped each fund’s holdings to the Ethos database of 7,400 companies, which are tagged for typical ESG screens (fossil fuel, tobacco, weapons, etc.) and rated for 45 ESG causes, including environmental causes like Climate Action, Life on Earth and Clean Water.

You can read about our data methodology here, which includes 250+ data sources such as carbon intensity, emissions reduction, environmental fines, and more.

Pension impact: funding global warming

The size of pension plan investments means they are significant funders of many companies they invest in. What companies do they choose to enable through their investments? What is the environmental impact of the companies they enable?

To answer these questions we used the Ethos platform to calculate environmental data for each of the three example pension plans, based on a weighted-average of data for holdings. For example, if Apple makes up 0.1% of a pension plan's holdings, Apple's environmental data (such as carbon emissions) makes up 0.1% of our analysis of the pension plan.

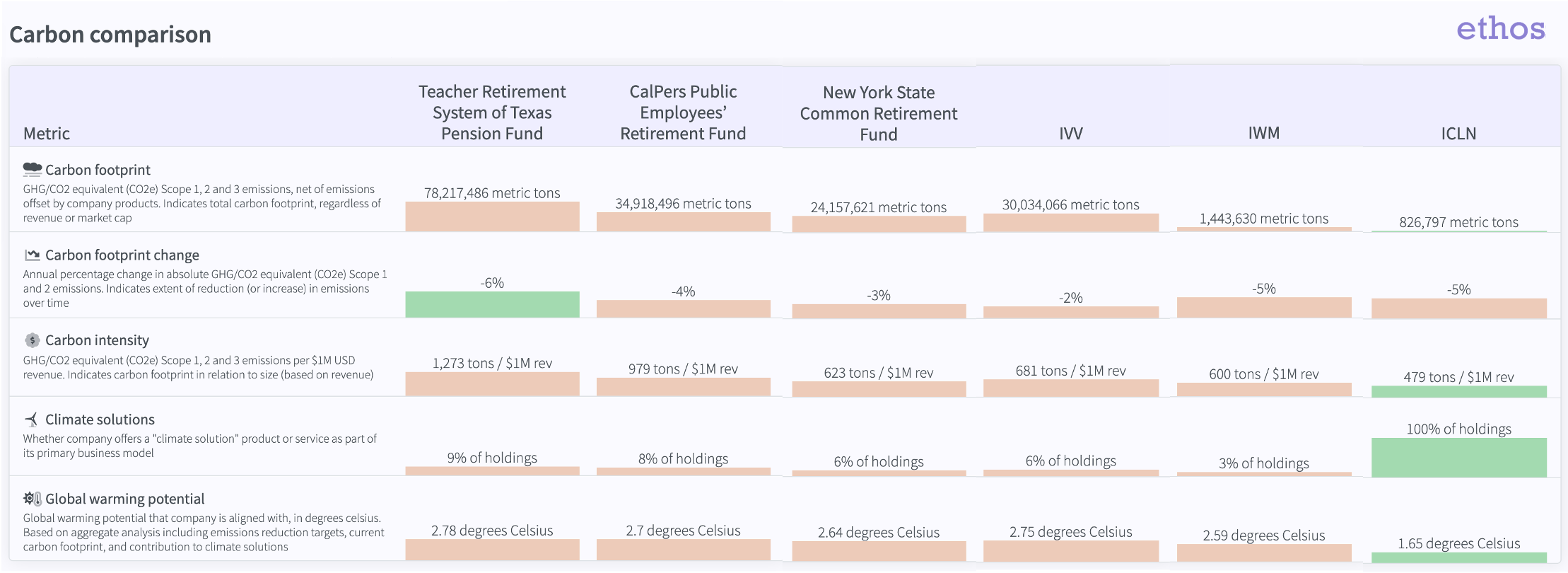

We compared data for each pension plan to three benchmarks:

- The iShares Russell 2000 ETF (IWM)

- The iShares Core S&P500 Index Fund ETF (IVV)

- The iShares Global Clean Energy Index Fund ETF (ICLN)

Here's how they compared on selected carbon-related metrics (click to view full-screen):

The Teacher Retirement System of Texas has the largest carbon footprint, is the most carbon intense, and has the highest global warming potential, though all of the funds are well above the global warming agreements of the Paris Agreement. Signed in 2015 by 195 countries, the Paris Agreement sets out to limit global warming to well below 2°C (3.6°F) above pre-industrial levels, and to pursue efforts to limit the increase to 1.5°C (2.7°F), recognizing that this would substantially reduce the impacts of climate change.

All metrics represent the weighted-average of fund holdings. Here's what they mean:

- Carbon footprint: indicates the scale of carbon emissions, or how much the fund contributes to total carbon emissions in the world regardless of size of company holdings. Includes Scope 1 emissions (direct emissions from owned or controlled sources), Scope 2 emissions (indirect emissions from the generation of purchased electricity, steam, heating and cooling consumed by the company), and Scope 3 emissions (all other indirect emissions that occur in a company's upstream and downstream value chain).

- Carbon footprint change: indicates how much the fund reduces its carbon footprint year-over-year. Negative numbers indicate a reduction.

- Carbon intensity: indicates how much carbon the fund produces per $1M USD revenue. This metric takes into account the size of fund holdings, to mitigate the penalty for large companies that emit more due to their size.

- Climate solutions: indicates the percent of fund holdings that offer "climate solution" product or service as part of their core business model. Examples of products and services that Ethos considers climate solutions include renewable energy, electric vehicle technology, sustainable agriculture, and automation that reduces carbon footprints.

- Global warming potential: indicates the degrees celsius of global warming that the company is aligned with, based on an aggregate analysis of the above metrics and forward-looking reduction targets. More info on this metric below.

To calculate global warming potential, Ethos considers a company's carbon footprint, carbon footprint change, carbon intensity, contribution to climate solutions, and forward-looking emissions reduction commitments made through the Science-Based Targets Initiative. Ethos also considers company commitments to achieve "net-zero", 1.5°C, or 2°C alignment where the company has made a credible commitment, based on public information.

Here's how the pension plans and benchmarks stack up on alignment with the Paris Agreement (click to view full-screen):

Pension plans are major funders in the landscape of ESG investing. Changes in their investment decisions -- investing in more low-carbon, climate-solution companies -- would make a significant difference in the effort to limit global warming and prevent the most catastrophic impacts of climate change.

How can we improve pension plans' performance on ESG issues?

Just 2.9% of 401k plans in the US have at least one fund dedicated to ESG issues, according to a recent Plan Sponsor Council of America member survey. You are probably invested in companies that extract or refine pollutants, mow down rainforests or mistreat people in some way.

So how can you influence what's in your 401k? Here are a few steps from the NY Times:

- Someone (or a committee of people) at your employer likely picks or approves the lineup of funds for your 401k. Ask a human resources person (or the president or another leader at a smaller organization)

- Ask if you can see details about what the retirement plan is investing in

- Consider starting small with a single request, such as adding a socially responsible fund focused on large American companies. If that’s successful, work on adding more over time

- Consider requesting a brokerage window (or "self-directed option") with your 401k. This is an option for employees to effectively have their own investment account within their 401k (buy and sell securities through a brokerage platform)

- If there is a sustainability committee, show them how some of the stocks in the retirement plan's funds may not be consistent with the company’s efforts elsewhere

The potential for changing pension and 401k plan investments is also limited by government regulation. In the US there have been major shifts over the past year in this area.

In October 2020, the Trump administration passed the "Financial Factors in Selecting Plan Investments" rule, making it more difficult for socially-minded investments to be included in select retirement plans. The rule had been proposed in June 2020 and immediately drew ire from many in the investment community. The department of labor received over 8500 comments, 96% of which were opposed. Opposition came also from traditional asset managers such as Vanguard, T. Rowe Price, Blackrock and others.

The Biden administration said early on that it would not enforce this rule.

Learn more

Want to learn more about how Ethos can help with assessing the impact of your portfolio, your client's portfolios, or your fund? Reach out to us at business@ethosESG.com.